Published

Personal Loan in Karimnagar | Instant Loan in Karimnagar

Table of contents

Personal Loan in Karimnagar | Instant Loan in Karimnagar

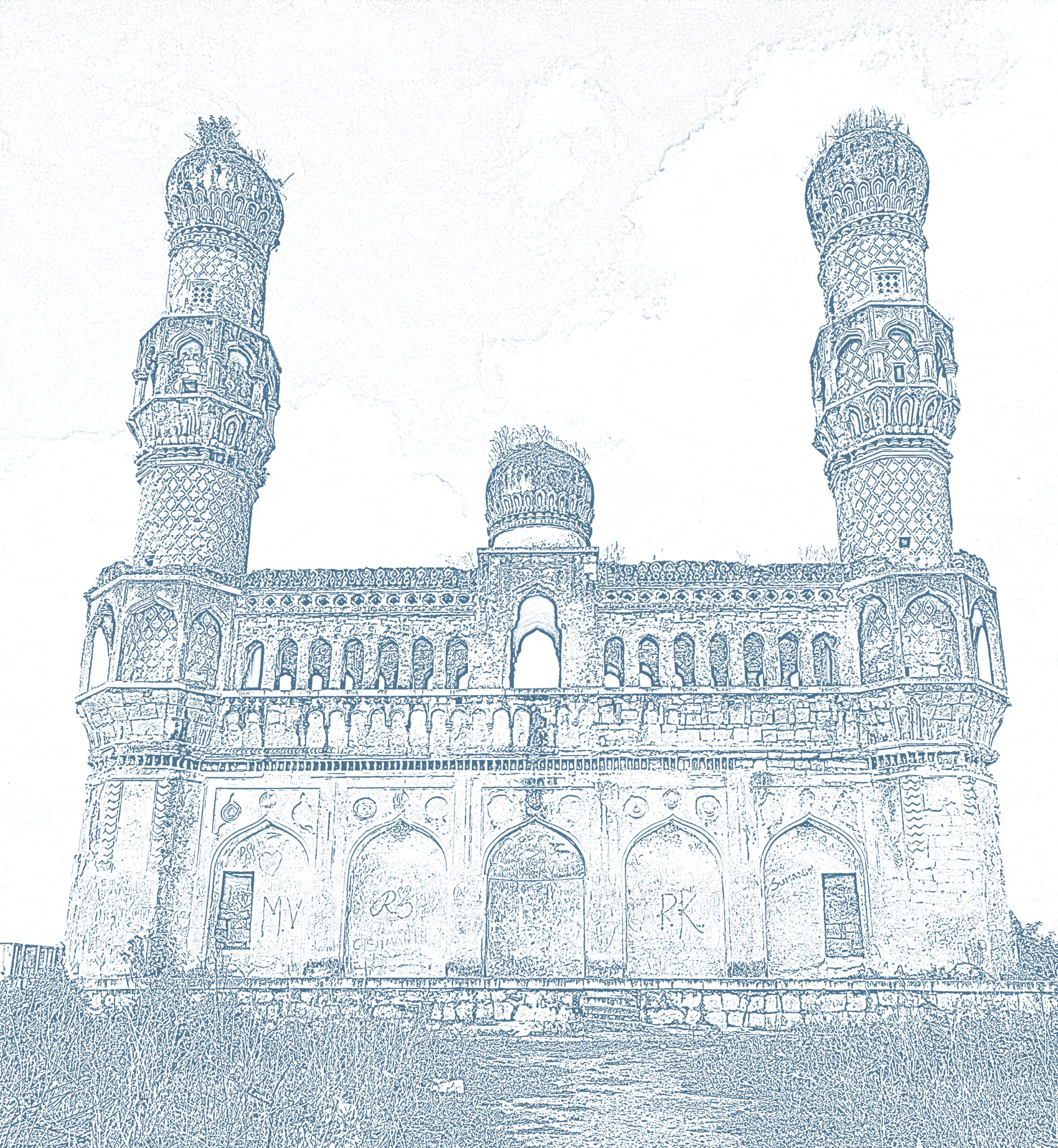

Karimnagar is the fifth-largest city of Telangana and is listed as one of the 20 most developed districts of India. Karimnagar is popularly called the “City of Granites” as it is one of the major granite producers of India, contributing significantly to the city’s economy. All the other sectors including agriculture, horticulture, education, health, and manufacturing industries serve as prominent economic activities of the region.

Karimnagar is rapidly developing into a significant business center of Telangana. With such swift developments, there is a huge demand for personal loans and instant cash loans. A multitude of public and private institutions provide personal loans in Karimnagar. You can get an online personal loan from StashFin to cover a wide range of expenses, such as paying your education fee, traveling to your dream destination, buying your favorite bike or car, etc.

Personal loan in Karimnagar with Dynamic interest Rates

If you are looking for a reliable and transparent loan provider in Karimnagar, then StashFin is a leading digital money lending platform that has been empowering individuals to fulfill their dreams. With an easy application process, StashFin offers you loan amounts ranging from ₹1000 to ₹500,000 at affordable interest rates starting from 11.99%.

At StashFin, availing of a personal loan in Karimnagar is very easy; you only have to follow three steps: Login/Register – Fill application – Upload KYC! You can apply for a personal loan in Karimnagar through the StashFin app or StashFin website, and soon the money will be disbursed to your bank account within four hours.

Eligibility Criteria to Apply for a Personal loan in Karimnagar

To apply for a personal loan in Karimnagar, you are required to provide your personal and professional details, KYC details (Aadhaar & PAN card), and relevant bank statements & salary slips. The loan amount, repayment tenure, and EMI will be fixed based on your eligibility and application form. Note that the loan application will only be accepted if you are an Indian citizen and at least 18 years and more.

Personal loans and Credit Line Card from StashFin:

Eligibility Criteria

To get an instant line of credit or a personal loan from StashFin, you need to be:

- Indian Citizen

- Above the age of 18

- Must have a source of income (either salaried or self-employed)

Documents required to avail instant Line of Credit or Personal Loan from StashFin:

- Address Proof (any one of Aadhaar Card/Voter ID/Passport/Driving License)

- Identity Proof (PAN ID)

- Bank Statement

Apply today for a Personal Loan or Credit Line Card, and fulfill your dreams with a quick cash loan from StashFin.

- All Posts

- All topics

- Bonds

- Cash Loan

- Child Education Insurance

- Corporate Bond

- Credit Cards

- Credit Report

- Credit Score

- Critical Illness Insurance

- Customer Success

- Cyber Insurance

- Design

- EMI Calculator

- EPF

- Expense Management

- Finance

- Home Appliance Insurance

- Home Insurance

- Industry News

- Instant Loan

- Insurance

- loan

- Loan Protection Insurance

- Medical Loans

- Mobile Loan

- Personal Loans

- Product

- Salary Protection

- Sentinel App

- Small Loan

- Software Engineering

- Stashfin App

- TeleMarketing

- Testimonials

- Trading Account

- Travel Insurance

- Wallet Protection

- Wedding Loans

A personal loan is often a saviour when you need financial assistance. Personal loans are flexible and accessible for various...

Taking out a personal loan is a common financial solution for meeting various expenses,...