Blogs & articles

Insights, tips, and stories to help you make smarter financial choices, stay updated with Stashfin’s latest news and ideas.

- All topics

- Credit Cards

- Insurance

- Bonds

- Credit Score

- Cyber Insurance

- EMI Calculator

- EPF

- Finance

- Cash Loan

- Credit Report

- TeleMarketing

- Home Insurance

- Industry News

- Instant Loan

- Corporate Bond

- Sentinel App

- Child Education Insurance

- Critical Illness Insurance

- Home Appliance Insurance

- loan

- Loan Protection Insurance

- Medical Loans

- Mobile Loan

- Personal Loans

- Salary Protection

- Small Loan

- Stashfin App

- Trading Account

- Travel Insurance

- Wallet Protection

How does Personal Loan impact Credit Score?

A personal loan is a sum of money that is borrowed for a variety of personal expenses – e.g., Marriage loans, medical loans, vacation loans, etc. It can be classified into secured and unsecured loans.

How to get an instant personal loan for self-employed?

Are you a self-employed/ small business owner and wondering how to get a personal loan? Well, think no more! You can apply for an instant and hassle-free personal loan from StashFin

Buy Laptops on EMI in India with StashFin Laptop Loans

You don’t need a credit card to buy a laptop anymore, use the StashFin to buy your laptop and repay in easy and flexible EMIs. Both salaried and self-employed individuals are eligible

How StashFin Instant Loan Helped Arun Yadav from Noida

As a company that started off with an aim to disrupt traditional lending in India, we always strive to create a reliable and hassle-free credit experience for our customers. Seeing our services meet our customers’

StashFin Credit Line and Credit Score: How are they related?

StashFin credit line is like a hybrid credit instrument that combines the best features of a credit card and a loan. It is much like a credit card, wherein you can borrow a predefined amount of money repeatedly,

Why Choose an Instant Personal Loan for Self-Employed?

It is hard to guarantee financial stability for self-employed persons since most of them face irregular incomes and the business world is quite dynamic. Traditionally, banks have always favored

FinTech vs Banks -Which is Better?

So, you have decided that you need to borrow some money. What is the better option for you – to go through a bank, or to try borrowing from a FinTech company?

Personal Loans vs. Credit Cards – Which is Better?

You need to borrow money. You have two options: Credit Cards or Personal Loans. Which is better?

Employee Expense Management Program

Expense Management refers to the tracking of employees’ spending and the reimbursement of these incurred costs by the company. In essence, as long as the expenditure is connected

How instant personal loan apps can be your friend?

Are you tired of having to rely on the bank to get a loan? The entire process of requesting a loan from the bank is tiring and time-consuming. Your loan application has to be reviewed by the bank,

How much loan can I get with my salary?

Now that you have decided to apply for a personal loan, the next question is how much loan am I eligible for? How much will they lend me based on my salary?

A Complete Guide on Choosing Your Best Personal Loan Online

Personal loans are like one-stop solutions for all kinds of contingent or emergency situations where money is urgently needed. Unlike loans customized for specific needs

The Beginner’s Guide to CIBIL Score

Banking and investment can seem like daunting tasks, especially to millennial professionals, what with all the technical jargon and endless paperwork. One of the most basic concepts that one needs

How to create a successful Financial Plan for yourself?

Financial planning, in essence, is the difference between people who are intimidated by money matters and ones who live a financially secure life. Although personal financial planning might seem

Hassle-Free Loan Made Reshma a Fan of StashFin

Hearing positive feedback from our customers makes us a happy lot. After all, we strive to deliver great convenience to our customers. We recently had the privilege of speaking to one of our loyal customers

Instant Personal Loan from StashFin

Personal loans are loans that help you tide over unplanned expenses and financial emergencies; it could be an unexpected medical expense or buying a laptop or a smartphone

Credit Card vs Credit Line Card: Which is better and why?

Is there a better alternative to credit cards? The answer is YES! Go for a StashFin Credit Line Card. It is SMARTER than a credit card and SIMPLER than a personal loan. With the StashFin Credit Line Card

Top 6 Reasons to Avail Instant Personal Loan from StashFin

A personal loan is a great financial product to help during a financial emergency. It does not have any end-usage restrictions like a home loan, appliance loan, etc. The loan can be used

Home Renovation Loan: Give Your Home a Makeover

StashFin Home Renovation Loan helps you enhance your home in more ways than one. Does your home need a fresh coat of paint? Or a change in electrical wiring? Do you want to remodel

StashFin Loans for Medical Emergency

A medical emergency could happen to anyone at any time; specifically, given the current pandemic situation. It could be a freak accident as you are riding home or a routine medical test

Bank Failure: What Happens When a Bank Fails

Banks are one of the most trusted institutions to keep your earnings and savings safe. Sadly, that’s not the case always; sometimes banks fail and fail big time. You can never predict if a bank

What to Do When Your Bank is in Trouble?

People assume that their savings and deposits are safe in a reputed bank and hope for a secure future. However, a series of bank failures like Punjab and Maharashtra Cooperative Bank Ltd.

How to Survive the Month-End Financial Crisis?

At the end of every month, do you find yourself running low on cash? Do you anxiously wait for the next salary-credited message from your bank?

Depositor Insurance and Risk-Free Banking

Over the years, banking has evolved as a social, customer-driven industry with increased checks and balances to safeguard customer assets. The government has also made many provisions

Personal Loans for Low-Salaried and Self-Employed

In the personal loans business, the person who is in a dire need of a loan does not get a loan. The reasons being the customer has a low salary or the customer is self-employed.

Loans for Illnesses that Medical Insurance Does Not Cover?

Health is wealth but when there is a sudden illness it needs a lot of wealth to pay the bills. A medical emergency can happen to anyone at any time. A medical insurance will turn out to be your best

Top 3 Road trips from Delhi with StashFin Credit Line Card

Do you want to explore the magnificent travel destinations around Delhi on a road trip? Then, worry no more; with StashFin Credit Line Card, load amount in your card and pay a visit to any

StashFin App Changing the way we look at Personal Loans?

We all have experienced the time-consuming, lengthy, frustrating process of applying for personal loans from traditional financial institutions. The strict eligibility criteria of these organizations make

Online Shopping with StashFin Instant Personal Loans

In today’s age, when almost everything can be bought with a few clicks, it’s no surprise to see financial solutions catching up with advanced technology. Furniture, food, or clothes — all things

Personal Loans to visit North East India

Are you an avid traveller, want to travel to a beautiful tourist place, but worrying about your expenses? Here you go! We have the best solutions for both of your worries. Visit North East India,

Loans for Vacations to Visit Goa for a Relaxed Weekend

Planning for a relaxed weekend in Goa? What’s stopping you? If it’s money, then we have the best solution for you. Avail personal loans for vacations from StashFin,

5 Things You Must Know Before Applying for a Personal Loan

Personal loans are quick funds to meet instant financial needs. It is one of the most convenient ways of borrowing money. Additionally, documentation for a personal loan is very simple.

Applying for a Personal Loan? Ask Yourself These 4 Questions

Applying for a personal loan is quick and easy; it comes in handy, especially when you’re in urgent need of money. Everyone knows that getting a loan would mean cutting down on your expenses

Tick Things off Your Bucket List with StashFin Personal Loans

We all have some bucket list things or dreams we wish to fulfill, things like a dream vacation, buying a new car, bike, or the latest iPhone, attending Arijit Singh’s concert, shopping, etc.

How to Get an Instant Personal Loan at 0 Processing Fees

Instant Personal Loans are quick loans that help you tide over a financial situation. However, keep an eye on terms of repayment, processing fees, and prepayment charges that could burn a hole in your pocket.

3 Tips for Using StashFin Credit Line Card While Traveling

Gone are the days when people used to carry cash while traveling. Many of us today have one or more credit cards or credit line cards. As time goes by, the number of credit or debit card frauds

How to avail Small Personal Loans from StashFin?

Imagine it is end of the month, as usual you’re on a tight budget. Out of the blue, you have a financial emergency. As it’s not a large amount, you won’t need a full-fledged bank loan.

Top 6 Road Trips to take in India with a Personal Loan

Many of you are planning to take a road trip once the pandemic situation gets better. A vacation refreshes the mind, and during times like this we understand the importance of taking

How StashFin Can Help to Tide Over Month-End Cash Crunch?

Do you also dread looking at the balance in your bank account at the end of the month? Does it seem like a long wait for the payday when you receive the “Salary Credited” message?

How to avail Mobile Loan from StashFin?

A good Smartphone is very essential in today’s world. Mobile phones are not only a mode of communication; it also simplifies our work and entertains us. Ever since the pandemic broke out, mobile

Bring in the New Year with the StashFin Credit Line Card

It’s that time of the year again! Christmas and New Year are around the corner, and all shops are loaded with year-end attractive sale offers. It is pretty difficult to escape them. From refrigerator to jewellery,

Wedding Shopping made easy with StashFin Card

Weddings hold a special place in everyone’s life. We all have some dreams attached to it. Some prefer a destination wedding while others want to have a big fat Indian wedding in their own hometown.

How To Do Easy Financial Planning With EMI Calculator

The purchase of any big-budget commodity often involves a loan. And why shouldn’t it? Credit is an enabler for most of us, allowing us to invest in ourselves, entertain, and even deal with emergencies

What To Do When Your Bank Fails?

Not everyone knows the economics that is at play in the financial sector. This comprehensive checklist will help you navigate through the choppy financial waters when it seems that the banks are struggling to survive and your bank may fail:-

Instant Cash Loan in 1 Hour for Self-Employed

Instant Cash Loans are a smart way to get out of any unplanned financial situation. Be it your month‑end cash crunch or a medical emergency or business-related crisis; with an immediate cash

Everything You Need to Know About Credit Score

Borrowing to tide over financial situations or buying something that you need but cannot afford right away is a good thing to do. However, as a borrower, it is important that you understand your personal credit reports,

Deposit Insurance Coverage in India

Banks are institutions that are trusted by millions of depositors to safeguard their money. Banks should not fail but they do for various reasons; bad management, defaulting loans, economic downturn, etc.

How StashFin Credit Line Card is Better than a Personal Loan

We all know that a personal loan is definitely a better option than a credit card. But is there any other financial product that is better than a personal loan? Yes, there is, it’s the StashFin all-inclusive Credit Line Card.

The Do’s and Don’ts of Personal Loan

Personal loans can help you fund diverse needs like medical expenses, business/investment, holidays, wedding expenses, purchasing consumer durables, home renovation, debt consolidation,

EMI: What is EMI and How is it Calculated?

You might require a loan for a multitude of reasons; such as education fees, travel expenses, shopping, medical emergencies, home renovation, and unforeseen emergencies.

5 Tips to Avail Personal Loans at Low-Interest Rates

Availing of personal loans with no collateral is easy, but it comes with high-interest rates. Does that mean you can never get personal loans at low interest rates? Not quite.

6 Common Personal Loan Myths – Busted!

Personal loans are very popular as they can be used for anything that you choose to; such as financing a wedding, paying education fees, medical emergencies, or clearing other debts.

A Beginners’ Guide to Personal Loans

A personal loan is an unsecured/collateral-free loan that can be availed to fund immediate financial requirements. If you are applying for a personal loan for the first time, you need to pay attention to the following factors.

5 Questions to Ask Yourself Before Taking a Personal Loan

Personal loans are a great way to deal with quick cash needs. They are an affordable alternative to credit cards, and they can be used to address all types of funding needs.

Buy Now Pay Later with StashFin Credit Line Card

Is your budget lean? Are you thinking of compromising on gifts for your wife’s birthday? Introducing the StashFin buy now pay later credit line card. From utility bills to shopping sprees,

Benefits Of StashFin Credit Line Card

Are you a salaried employee facing a cash crunch? Are you Struggling to pay for your child’s education? Are you in need of a medical emergency loan for treatment? If yes, then StashFin

StashFin Credit Line Card Charges

StashFin Credit Line Card is a multipurpose flexible and convenient financial product that can be used as a debit card, credit card, and personal loan. It comes with a lot of additional

Documents Required for Salaried & Self-Employed

Personal loans are unsecured loans that can be used to fund a variety of financial needs. With financial institutions offering personal loans online, it has become easier than ever to apply

5 Reasons Why BNPL is The Choice for Credit Shopping

The rapidly changing financial ecosystem has given rise to a credit option known as buy now pay later. It is an increasingly popular scheme which appeals to the millennials and GenZ.

Things to consider before applying for a personal loan

Minimum documentation, instant disbursal of funds, and no collateral make personal loans an ideal credit option for immediate funds requirements. However, it is important to consider things

Personal Loan for Home Renovation

Have you been thinking of replacing that old furniture in your living room? Do you feel like revamping your kitchen? Home renovation is a costly affair. Your savings may not be able to fund it and reaching

5 Good Reasons to Avail Personal Loans

Certain loans can only be used for specific end purposes, e.g., vehicle loans, home loans, mobile loans, etc. However, the same is not true for personal loans. A personal loan can be used for home

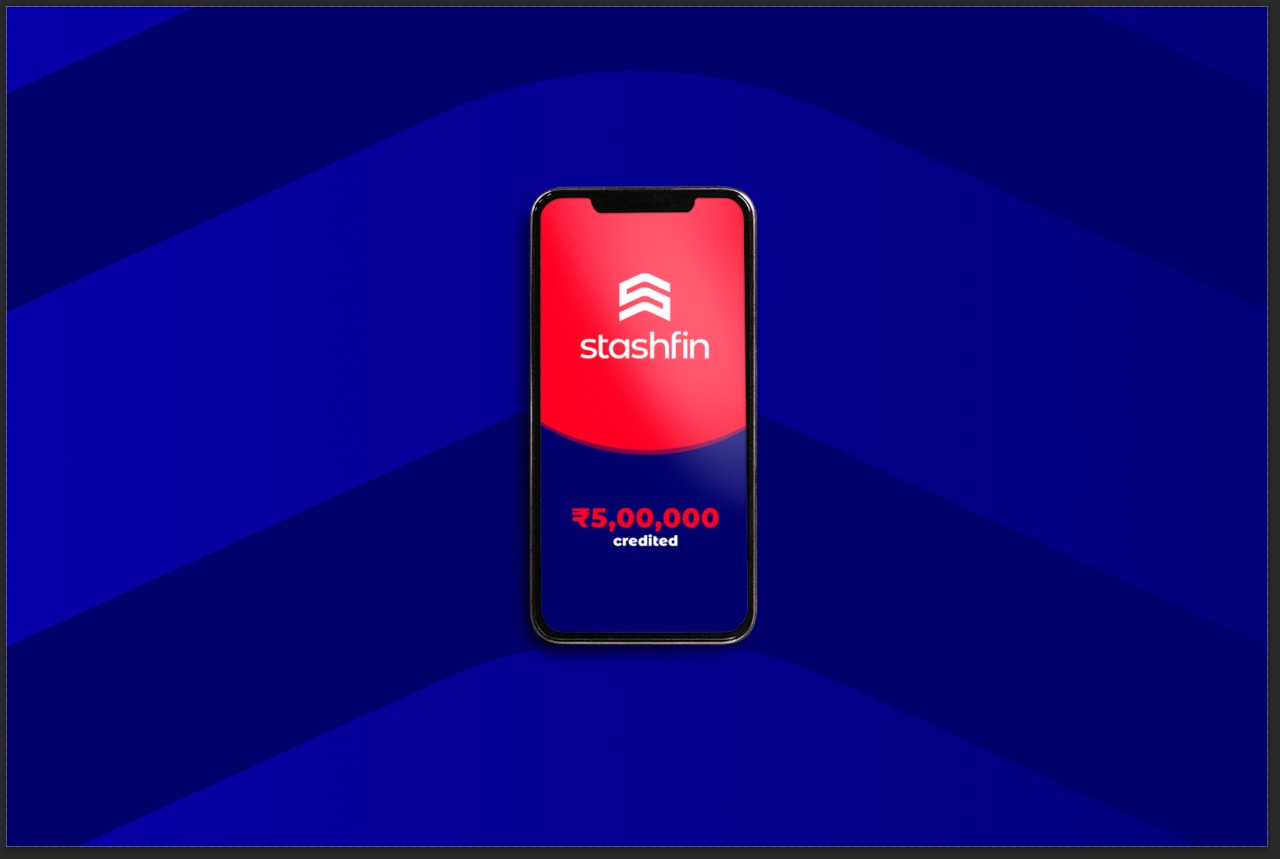

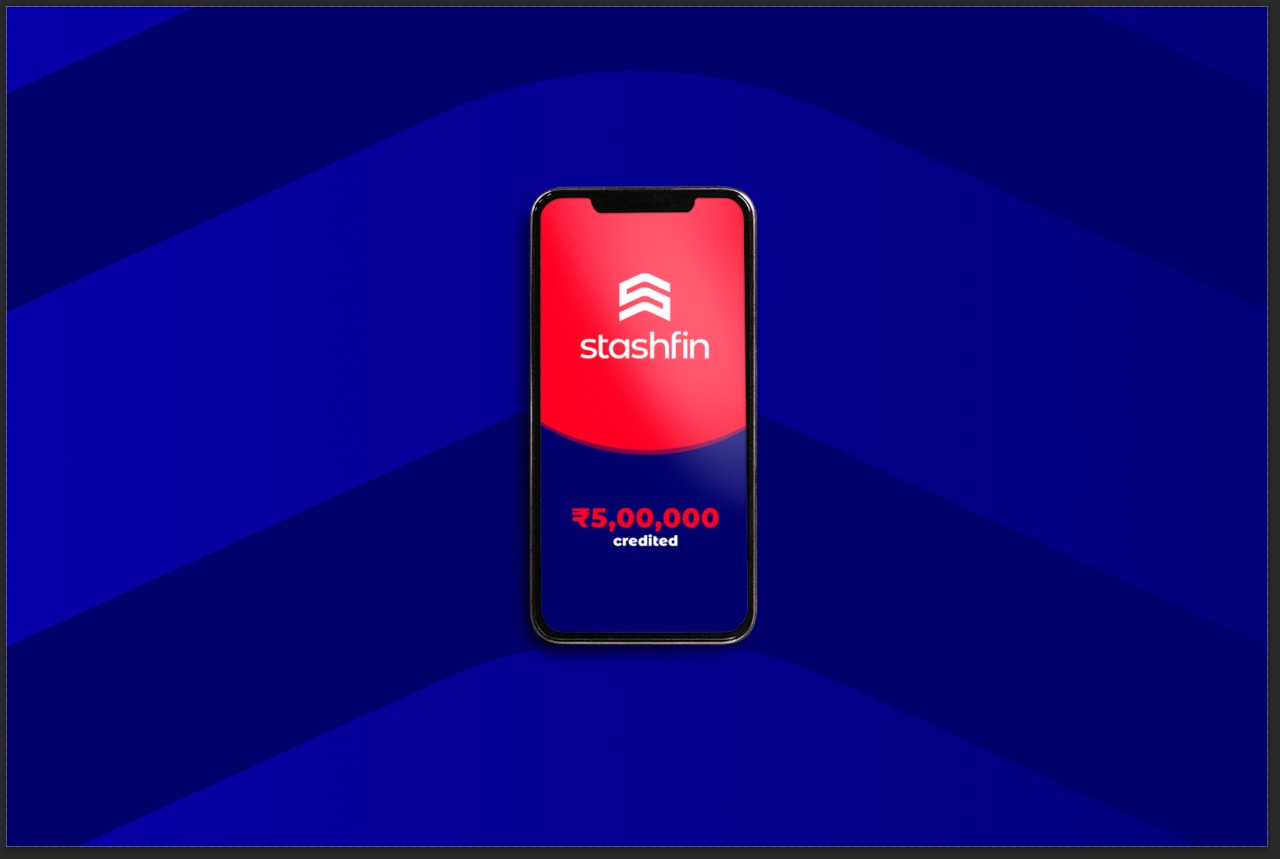

Say hello to the new StashFin App!

Waiting in long lines and constant visits to the bank to get your loan approved is now a thing of the past. Say hello to the StashFin App! The fastest way to access the required funds to aid your financial needs.

Everything About StashFin Credit Line Card

What is a StashFin Credit Line Card? StashFin Credit Line Card is a smart and convenient alternative to credit cards and personal loans. It offers flexible loan amounts ranging from ₹1,000/- to ₹ 5,00,000/-

5 Scenarios to avail a Personal Loan

No matter how well we plan our expenses, life presents us with financial challenges that we just couldn’t have imagined. Yes, sometimes our savings and other funds may suffice,

The StashFin Credit Line Advantage

Versatile, flexible, easy to avail, no collateral, hassle-free application process, minimum paperwork, and more. Yes, there are numerous advantages to having the StashFin credit line card.

Don’ts while Applying for a personal loan

The hassle-free application process, low-interest rate, zero collateral, and instant disbursal of funds makes personal loans a preferred credit option when unplanned expenses arise.

5 Road Trips in Goa with StashFin Credit Line Card

Want to explore the former Portuguese state of India, but worried about how to finance your road trips? Well, StashFin has a solution for you. Visit Goa, a relaxing tourist destination

Tips to Manage Personal Loan EMI Payments

Unlike most loans, a personal loan is free of collateral. If managed responsibly, a personal loan can be a great tool to tide over unplanned financial expenses. It can be used to cover medical emergencies,

Small Loans for Low CIBIL Score

Having a good credit score is the parameter for your creditworthiness. Lenders rely on your CIBIL score before approving your loan application. Asking for a huge loan with a low CIBIL

StashFin Uses AI and ML for Fraud Detection

Financial frauds are growing increasingly complex day by day, and the financial service sector cannot afford to take them lightly, be it fintech companies, retail banking, or insurance service companies.

StashFin Personal Loan at Zero Prepayment Fees

With careful consideration towards the budget, monthly EMI payments, and interest rates levied by the credit provider; Mr. Vikram had applied for a personal loan to purchase trekking

StashFin Personal Loan for Holiday Shopping

With the holiday season around the corner, everyone loves receiving – gifts, lovely vacation surprises, and lots of celebrations including parties. Holiday expenses may overshoot your budget sometimes.

Year-End Shopping with StashFin Instant Loans

Get up to 90% off on all clothing, footwear, and accessories. Best-selling jewellery @ Rs. 99 Only! Season’s discounts! Deal of the month! End-of-season sale!

Fintech and its Impact on The Banking Sector

India has overshadowed United Kingdom, Germany, and Singapore with 1,500 fintech start-ups according to a study conducted between 2015 to 2018. As per the market data forecast,

Latest Trends in the Financial Industry

In India, the influence of millennials on its demography, rapid penetration of smart devices, and strategic mergers amongst fintech companies have accelerated the growth of fintech services.

How StashFin is using AI & ML to detect Frauds

According to the Global Economic Crime and Fraud Survey (2019-2020) conducted by PwC, the losses due to global fraud amounted to US $42 billion. Of the surveyed number, 47% of financial

How Personal Loan Helped Anubhav Nanda

We love it when our customers are satisfied. It motivates us to give you a hassle-free borrowing experience while saving your valuable time. Recently, we had a quick telephonic conversation

Clear Credit Debts Using StashFin Credit Line Card

Due to multiple offers and approaches made by banks, Mr. Rudra had accumulated 4 credit cards in 2 years during the course of his employment. One was a shopping card that availed various

Avail StashFin Personal Loan of Rs. 1 Lakh

Does your startup require more capital? Is your start-up not eligible for the approval of a credit line from the banks? Don’t worry, StashFin has a solution.

Reasons For the Rejection of Personal Loans

The no-collateral feature of a personal loan makes it one of the most sought-after forms of a loan; because it can be used to meet any immediate financial needs, be it, wedding,

How Much Personal Loan Can I Get?

Are you facing a cash crunch because of an increase in demand or prices of the product? Have you ever felt like taking a personal loan but backed out due to the lack of basic knowledge

Personal Loan Despite a Low Credit Score?

Yes, that’s possible; you read that right. Well, it’s true that the first thing a lender checks when you approach them for a personal loan is your CIBIL or credit score; because your credit history

Personal Financial Planning: The Importance of Financial Habits

You earn enough to make ends meet. You pay your bills on time. You create a monthly budget and stick to it. You’ve saved up for a rainy day, and even have a retirement corpus up and running.

What is Debt Trap and Six Ways to Avoid Getting into it

‘Don’t bite off more than you can chew’ is something we’ve often heard. It is also something that few seem to follow. That people would like to access funds, and additional funds

Five Factors to Consider When Choosing a Personal Loan Tenure

As we’ve often maintained, personal loans aren’t always planned, and it helps to have a healthy financial record so that your personal loan application is not rejected.

Reasons for Personal Loan Rejection & How to Avoid It

Personal loans are not always planned. Unlike an education, vehicle, or home loan, personal loans do not usually feature in an individual’s plans. But, when the time arrives for someone

4 Smart Ways to Consolidate Debt Without Hurting Your Credit Score

One of the key factors of healthy financial habits is to keep track of your debts and to repay them in full and on time. Doing this impacts your credit score and determines whether lenders

Five Tips to Manage Personal Loan Monthly EMI Burden

People take personal loans for multiple reasons. While personal loans may not always be planned, it helps that the application process is simple, the amount is disbursed quickly,

Eight Ways to Be Smart with Money in Your 20s – Financial Guidance

The earlier one begins to save, the better one learns to manage their finances. In fact, it would be prudent to begin saving from your first job, or your first paid internship.

Taking a personal loan during the festive season

The festive season in India usually starts around October with various festivals including Navratri, Dussehra, Durga Puja, Dhanteras Diwali, Eid, and Gurpurab, and continues till December

What Makes Stashfin One of the Best Credit Line and Personal Loan Apps in India?

Enjoy the power of instant money with Stashfin – India’s fastest, easiest, safest, and smartest Credit Line and Instant loan App. Stashfin is powered by Akara Capital Advisors Private Limited,

Personal Loans for Home Renovation – What’s the Best Solution?

Personal loans for Home Renovation are sought by applicants who want to improve/repair/upgrade their homes in various ways such as flooring, painting, tiling, upgradation, remodeling,

Instant Travel Loans by Stashfin

After various lockdowns and social distancing during COVID times, travel has become a need for young individuals. With the advent of numerous travel influencers, many unexplored

Apply for a Marriage Loan Online: Personal Loan for Your Wedding

A wedding is one of the most important events in anybody’s lifetime. A lot of people dream of making their wedding one of the best experiences in their lives, be it through destination

Buy the Latest Smartphones with Instant Personal Loan from Stashfin

Smartphones have become a necessity in everyone’s lives with the advent of new technologies and on-the-go lifestyle. In the era of digital connectivity, consumers have plenty

Does Stashfin Provide Consumer Durable Loans?

Eyeing an upgrade for a television? Or looking to buy an air purifier? Fancy a kitchen consumer durables update? Be it a new TV, air purifier, refrigerator, microwave, smartphone, laptop,

6 Quick Tips to Save Yourself from Financial Frauds

We all have heard the term Sharing is Caring. And it is true when we share, it helps further strengthen our relationship with our loved ones. But when it comes to sharing

How to get the best instant personal loan rates and good credit limit in 2023?

Instant Personal Loan Apps these days can offer you quick approvals, instant fund transfers to your bank accounts, attractive loan rates, easy EMIs, and the convenience of flexible

Get Personal Loan @ 0% Interest Rate

Getting 0% interest for up to 30 days is now possible with Stashfin Credit Line and Loans App. This is a money saving feature from Stashfin which will help users take a loan especially

Shark Tank Season is on | How to start a business with Stashfin?

The Shark Tank season 2 is here and we are witnessing a lot of new businesses in various industries and sectors getting investments and deals from Indian sharks a.k.a. investors.

Top 5 reasons why you should get personal loan to help you in emergencies

There are times when people require instant funds without any hassle. It can be due to any medical emergency, purchasing any essential electronic appliance or renovating your abode.

How to get Instant Personal Loan For Self Employed

If you are self-employed, then you are well aware of the fact that the need for funds can arise at any point in life. Be it about expanding your business, renovating your residence, or planning

How to Avoid Personal Loan Scams

Nowadays, availing of a personal loan has become a common practice for individuals to gain access to easy funds. Since the onset of technology, getting such a loan has been relatively

Know Everything About the Process of Personal Loan

The need for instant funds can arise anytime, and what is better than an instant personal loan? Nowadays, many people use credit cards to access funds, but they don’t know

A Guide On How To Be Smart About Instant Personal Loans

To meet short-term financial goals, online instant personal loans have gained much popularity in recent years and is in the trend now. Instead of a credit card which generally

How to Apply for Zero Interest Rates Personal Loan?

In today’s time, the trend of availing of a personal loan has witnessed an upsurge. The access to funds instantly and easily has pushed more and more people towards it. Moreover, personal

How Personal Loan Apps Are Leading The Way To A Financially Healthier India

In the current digital era, availing the facility of a loan is as easy as ordering groceries/food from your smartphone by easily sitting in your comfort zone. Open your App Store/Play Store

7 Benefits of Having a Personal Loan App on Your Mobile Phone

To avail a personal line of credit, nowadays, you don’t need to go anywhere. It’s just you and your internet-enabled smartphone. Since the onset of technology, availing

Different Types of loan available in India

In India, people avail loans for various kinds of reasons. From purchasing a car to purchasing a home to even renovating it, there are several types of loans available in India.

Easy Loan Planning with Personal Loan Calculator

The urgent need for funds can arise anytime, and the trend to avail of personal loans is rising. In the current era of digitalization, getting a personal loan is as easy as ordering

5 Mistakes to Avoid While Applying for a Personal Loan

One of the best financial facilities available in the current era is a personal loan. You just have to search for “personal loan apply online” on the web, and you are more than good to go.

Personal Loan for Salaried Employees: All You Need To Know

If you are a salaried employee, you might know the importance of a personal loan. However, most such loans are availed by salaried employees only as they often

How to Use Instant Personal Loans to Make the Most of IPL Season: Tips and Tricks

When it comes to cricket, apart from all the international series that pull all the eyes, another type is the Indian Premier League, where all the matches are held in India

Features and Benefits of Fast Cash Loans

If you are looking for access to easy and instant funds, then instead of asking from your friend or relative, it is always better to opt for instant cash loans.

Five Ways To Choose The Best Personal Loan

Nowadays, opting for an instant personal loan is as easy as ordering groceries from your smartphone. However, you need to be well aware of the fact that all the checkpoints

IPL Season Special: Instant Personal Loan Offers and Benefits Explained

It’s the IPL season! The cricket heat is on, and this is the long festival which has been celebrated in India every year for over a decade. When it comes to celebrations, there might

How does Personal Loan EMI Calculator works?

For those who are in need of emergency funds, personal loans are one of the best options to avail. However, before availing it, using an EMI calculator has become quite

Four Ways To Get The Best Personal Loan Interest Rate

One of the best ways to avail instant funds during emergencies is by going for a low-interest personal loan online. Instead of asking a friend or relative, availing an instant loan

The Best Way To Get Personal Loan Online

In order to gain access to instant funds during emergency times, personal loans online have emerged as one of the best options in the current times. Many people move towards

5 Smart Ways to Make Use of an Online Personal Loan

Many times, people require immediate financial help. Nowadays, instead of asking a friend or relative for extra funds sounds odd as; if you have an internet-enabled smartphone

Factors That Decide Your Personal Loan Eligibility

The need for money can arise at any given moment for any individual. This has led to a noticeable increase in the popularity of personal loans.

5 Personal Loan Benefits To Know Before Applying

In order to cover unexpected expenses, long gone are the days when people actually used to ask their friends or relatives for a few bucks. Nowadays, one of the best schemes

5 things you should not do to get a personal Loan

If you are looking for instant funds, an online personal loan is one of the best facilities you can avail in the current times. With easy access to the internet, things have become

Simple Tips To Improve The Personal Loan Application

If you are looking for a personal loan, then you are on the right track. Starting from the application to disbursement, we are here for you to offer you the best. Our personal loan app

Key Factors Affecting Your Personal Loan Interest Rates

The days when you actually had to travel to a nearby financial institution to avail of such a loan are way behind. Now, it’s just you and your internet-enabled smartphone. Stashfin

All You Need to Know About Small Personal Loans Online

In the current fast-paced world, financial stability has become a very crucial factor for individuals striving to achieve their goals and aspirations. A small loan for personal use

All You Need to Know about Personal Loan Disbursal Process

Availing of a personal loan via a personal loan app is one of the simplest things one can do in the current era to avail of emergency funds. Instead of asking a friend or relative

How to Get Personal loan for Salaried Employees

It is a well-known fact that personal loans have emerged as a versatile and accessible means of achieving our desires and managing unexpected expenses. Stashfin

The importance of EMI Calculator in getting a Personal Loan

Be it any type of loan, EMIs (Equated Monthly Installments) are an integral part of it. Whenever a potential borrower plans to avail of a loan, they agree to repay the amount

Why You Should Use An Online Loan App For Your Finance Requirements

In the current digital age, managing financial requirements has become quite convenient and accessible than ever before. Especially after the Covid-19 outbreak, availing a personal

Pros and Cons of Personal Loan app

One of the trendiest ways to avail of instant funds for personal use is a personal loan. It has completely revolutionized how people avail funds and has been able to get more

What are the eligibility criteria & benefits of quick loan

Availing a quick loan nowadays is as easy as ordering food from your smartphone. Just a few simple taps, and you are more than good to go. However, to avail such facilities, choosing

How to get Instant Cash Loan in no time

If you are looking for immediate financial help, availing instant cash loan online is one of the best ways to get it. Long gone are the days when people used to ask for money

What are Small Personal Loan – Features and Benefits

If you are looking for a small personal loan, then you are reading the right article. In the current times, where digitization has taken over, saving time is everyone’s topmost priority.

Smart Ways to Make Use of Online Personal Loan

Before you opt for a personal loan via Stashfin, one of the best personal instant loan app available on the market, be clear about why you need a loan. It is essential to understand

Personal Loan Advice & Tips for Students & Professionals

If you are a student or a working professional looking for financial help, a personal loan is one of the trendiest ways to do so. Long gone are the days when people actually used to ask for funds

Benefits & Features of Taking Mobile on Loan online

If you are planning to purchase a smartphone, you might be well aware by now that the prices of the same are touching the sky. There is no doubt in the fact that a good

Benefits of Consolidating Debt With An Instant Personal Loan

If you plan to consolidate your debt much quicker, then it’s better to get a personal loan online instant approval now. This is because, recently, this has become one

What Makes Stashfin One of the Best Credit Line and Personal Loan Apps in India?

Enjoy the power of instant money with Stashfin – India’s fastest, easiest, safest, and smartest Credit Line and Instant loan App. Stashfin is powered by Akara Capital Advisors Private Limited

Calculate Your Eligibility With Personal Loan Calculator

If you are planning to opt for a personal loan, keep in mind to have crossed a checklist before you do so. Availing of such loan types is undoubtedly an easy task, but you need

How Economic Factors Affect Personal Loan Interest Rate

Suppose you have ever availed a personal loan or are planning for the lowest interest rate on personal loan to fulfill personal expenses. In that case, you might be well aware of how economic

Factors Influencing Personal Loan Approval: Credit Score, Income, and More

If you are looking for a personal loan, then you might be very well aware that many factors come into play for the personal loan application approval. From credit score

How Instant Personal Loan Disbursal Works: A Step-by-Step Guide

If you are looking for immediate personal financial help, then an instant personal loan is the right way to fulfill this need. Long gone are the days when people actually used to ask

Instant Online Loans: Convenient and Fast Financing Solutions at Your Fingertips

It feels like a different era when it was difficult to get a loan. With so many lenders looking to provide you a loan, getting one nowadays has become so simple that as long as you have a stable income

Credit Line and Instant Personal Loans in Ludhiana

Ludhiana is the largest and one of the oldest cities in Punjab. It is also shortlisted by the government of India to be developed as a smart city. Ludhiana houses a large number

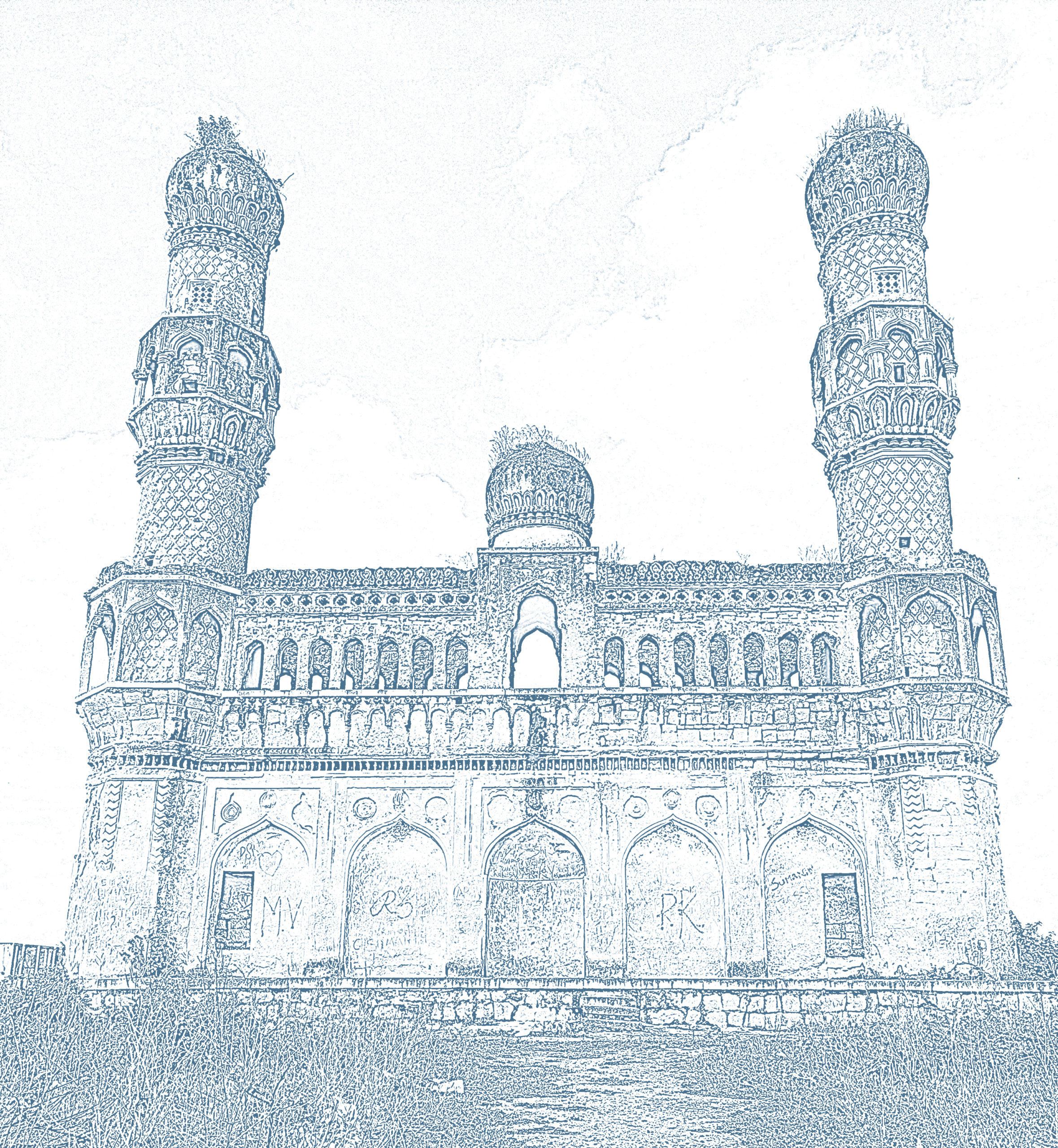

Personal Loan in Karimnagar | Instant Loan in Karimnagar

Karimnagar is the fifth-largest city of Telangana and is listed as one of the 20 most developed districts of India. Karimnagar is popularly called the “City of Granites” as it is one

Credit Line and Personal Loans in Patna

Patna, the capital city and the largest city of Bihar, is the 21st fastest growing city in the world, and the fifth fastest-growing city in India. Also known as the ancient Pataliputra,

Credit Line and instant Personal Loans in Anantapur

Anantapur is the largest district in Andhra Pradesh. It has great potential to be an educational hub and an industrial hub as it is strategically located between Bangalore

Access Quick Funds with Credit Line Personal Loans in Warangle

Warangal is the second-largest city in Telangana that has seen rapid growth and urbanization over the years. Agriculture is the major source of income here. The city holds

Quick Funds with Credit Line Personal Loans in Andhra Pradesh

Krishna is one of the 9 districts in the coastal Andhra region. It is named after one of the longest rivers in India. Machilipatnam is the administrative headquarters, and Vijayawada

Credit Line and Personal Loans in Vellore

Often called the Fort City, Vellore is an economically important city in the state of Tamil Nadu with an overabundance of historical remnants and ancient cultures. It is the biggest exporter

Credit Line and Personal Loans in Kurnool

Often referred to as the “Gateway of Rayalaseema”, Kurnool is one of the largest cities and the fourth most populous city in Andhra Pradesh. The major economic sectors in Kurnool

Credit Line and Personal Loans in Rajkot

Rajkot is the 28th urban agglomeration in India and is ranked as 22nd in “World’s fastest-growing cities & urban areas” for the period 2006 to 2020. It is the center for social,

Credit Line and Personal Loans in Salem

Salem, in Tamil Nadu, is a major industrial hub and textile center of India. The city is also called the “Steel City” as it is home to one of the world’s leading steel producers – Salem Steel Plant.

Credit Line and Personal Loans in Madurai

Popularly known as Athens of the East, Madurai is the 3rd largest city and the cultural capital of Tamil Nadu. With an illustrious history, Madurai has grown up as a major commercial

Credit Line and Personal Loans in Aurangabad

Aurangabad, the “City of Gates” is the 5th largest city in Maharashtra and a major commercial center. It is a major production center of high-quality cotton textile and artistic

Credit Line and Personal Loans in Nagpur

Nagpur is known as “Orange City” because it is a major trade center of oranges that are cultivated in the region. Nagpur is the winter capital of the state of Maharashtra.

Get Online Personal Loan in Kanpur

Kanpur is the second-largest city in Uttar Pradesh and the 12th most populous city in India. It is one of the most industrialized cities of Uttar Pradesh. The city is famous for its fine

Credit Line and Personal Loans in Dehradun

Dehradun is the capital of Uttarakhand and a popular hill station. It is the largest and the most populated city in Uttarakhand. Dehradun is often regarded as Devbhoomi or the “Land of the Gods”.

Credit Line and Personal Loans in Agra

Agra is one of the most populous cities in Uttar Pradesh and the 24th most populous city in India. The city is home to one of the world’s seven wonders (Taj Mahal), Agra Fort, Fatehpur Sikri,

Credit Line and Personal Loans in Bhopal

Located in the central part of India, Bhopal is known as the City of Lakes and is the capital city of Madhya Pradesh. It is the second-largest city in Madhya Pradesh and the only city to be ruled by the Begums

Credit Line and Personal Loans in Lucknow

Lucknow is the capital city and also the largest city of Uttar Pradesh. It is the eleventh most populous city of India. It is a city with bustling bylanes, amazing kebabs, culinary delights,

Securing Your Dreams: Applying for Personal Loans to Achieve Your Goals

Whether looking to fund your higher education, a foreign trip, your wedding, or any of your other goals, one thing which can help you out when everything else fails is a personal loan.

Effortless Borrowing with Top Loan Apps: Your Key to Financial Flexibility

India is a country that is currently undergoing several revolutions, not just a digital revolution but also a financial and credit one. Today lenders have made it exceptionally easy to get a loan,

Small Loan Apps: A Convenient Solution for Short-Term Financial Needs

Since the Covid-19 outbreak, more and more people have been inclined towards the internet to apply for small personal loan online. Long gone are the days when individuals

Tips And Tricks On How To Navigate The Loan Application Process

In today’s fast-paced world, where time is of the essence, loan apps have emerged as a convenient solution for those seeking quick access to funds. Whether you’re in need of a personal loan

Estimate Your Monthly Payments and Interest With Our Loan Calculator

When considering financial decisions that can impact one’s life long-term, one must always plan properly to make informed decisions.

How Scan and Pay is facilitating digital payments

India is going through a digital financial revolution, and UPI payment app are leading it. This has put India on the world map for accessible instant payment apps.

What are UPI Payments, and How to Use Them?

The world is looking for India and its revolutionary inter-bank instant payment system, UPI. India’s flagship instant payment system UPI has reached even France now,

What is the Future of UPI Payments in India?

India is undergoing a digital financial revolution that has shaken the digital payments landscape. India’s flagship instant payment system UPI has put India on the map

How Personal Loan app are Changing the game of Lending

In recent years, there has been a remarkable surge in personal loan app popularity in India. These apps offer a convenient and efficient way for people to access funds

The Definitive Guide to UPI Payments for Businesses

UPI services have put India at the forefront of the digital financial revolution and made it a global power. Not only making financial transactions easy, convenient,

Unable to get loan approvals? This may be the reason why!

Securing loan approval at crucial moments of need can prove to be a less than seamless journey for many individuals. The notifications of rejected loan applications often

What is small personal loan and how to apply for it online

Over the past few years, there has been a remarkable rise in the popularity of personal loan apps in India. These apps present a convenient and efficient solution for individuals

9 Benefits Of Choosing An Online Loan App

When we imagine getting an instant personal loan, we might picture people standing in line, waiting for many extra steps, and feeling frustrated. But thanks to technology,

Cash Loan: Know all that you need to know about Cash Loan

Gone are the days when people used to ask for financial help from their friends. Nowadays, they simply avail a personal loan from their smartphone and repay

The reason why instant loan is everyone’s obsession nowadays

If you have spent even a bit of time online, you might have seen everyone talking about getting an instant loan nowadays. But what is up with it?

Common EMI Mistakes to Avoid

There is no doubt in the fact that managing your finances can be a tricky act, and one misstep can stress you out. Among these responsibilities, perhaps one of the most

The benefits of instant personal loans and why it’s getting popular day by day?

An instant loan has recently gained so much popularity, especially after the Covid-19 outbreak. Long gone are the days when people relied on friends or relatives for some funds.

Advantages of Borrowing Personal Loans from a Money Loan App

Personal loans are helpful in case of emergencies and unprecedented financial situations. They are relatively easy to obtain and are flexible regarding the loan amount,

Reasons why UPI payment has become famous in India

The growth and acceptance of UPI can be entirely attributed to the ease with which it can be installed on the mobile phone and used without any complexity. The wide-scale availability

Small Personal Loan To Consider When You Need Instant Cash

In life, there are times when you suddenly need money, like when you have to pay for a surprise expense or fix something important. When this happens, a small personal loan can be a real lifesaver.

Steps To Avail of an Instant Loan Online – A Comprehensive Guide

The days when people used to rely on their friends or relatives for financial assistance are way behind us. Nowadays, the only best friend who is always there for you is your internet-enabled smartphone.

The Importance of EMI Calculator In Getting a Personal Loan

Long gone are the days when people used to call up their relatives or friends to avail some financial assistance. Nowadays, as smartphones have become human’s round-the-clock

How Can I Get An Instant Loan Online In India?

With Stashfin, the top rated instant loan app by your side, availing of this facility is as easy as ordering your favourite food items by simply tapping a few times on your smartphone.

How A Quick Cash Loan App Is A Better Option

In the current fast-paced and digital world, financial emergencies can strike at any time, leaving many people in need of quick and super-convenient solutions.

Top 8 Personal Loan Finance Mistakes That Everyone Should Avoid

Securing personal loan finance offers numerous financial benefits and can be a prudent choice. They offer individuals a versatile and easily accessible method

Never Run Out Of Cash With Fast Cash Personal Loan

In the current dynamic and unpredictable world, unforeseen expenses can surface when you least expect them, leaving your financial stability in question.

How A Personal Loan can fulfill your World Cup Dream

If you are a cricket enthusiast, then watching a Cricket World Cup match live is a dream event without any doubt. While watching the same on television can be exciting

Get To Know About Personal Loan Eligibility & Documents

Exploring the realm of personal loan represents a pivotal stride in realizing diverse financial ambitions, be it the consolidation of debts, the pursuit of advanced education,

What Happens If Your Personal Loan EMI Bounces?

In the current digital era, many individuals turn towards a personal loan when they need extra financial funds for various kinds of reasons. However, it is essential to remember

Empowering the Indian Jawans: Financial Solutions Tailored for the Indian Armed Forces

The unique demands and uncertainties of military life make it essential to manage your finances wisely. In this blog, we’ll explore the key aspects of financial literacy and provide

Light Up Your Homes This Diwali By Taking A Personal Loan

Obtaining a personal loan can be a prudent decision during Diwali, as it furnishes a financial boost to enhance your celebration of this festive occasion with zest and opulence.

Boost your financial freedom this Diwali with a quick personal loan

Getting ready for the festive period often involves various expenses. Whether embellishing your home, buying gifts, hosting gatherings, or engaging in beloved traditions,

Plan for Perfect Festive with Instant Personal Loan

Preparing for a flawless festive season often entails a multitude of expenditures. From adorning your residence and purchasing presents to hosting gatherings and participating

Emergency Loans in India – Interest Rates and How to Apply for Urgent Loans

Unforeseen circumstances frequently give rise to immediate and pressing financial needs within the intricate fabric of personal finance. In response to such unexpected challenges

How to get Lowest Interest Rate on Personal Loan

Financial flexibility is the present as well as the future and is undoubtedly of utmost paramount importance! In order to manage expenses, consolidate ongoing debts, or fulfill

How to Start a Successful Flower Business in India with Instant Loans?

In the dynamic realm of business endeavors, individuals passionate about flowers are increasingly exploring innovative financial solutions to transform their floral aspirations

Stashfin Stentinel: Bharatiye Sashastra Balon ko Sashakt banane ke liye ek Marg Darshak Path

Bharatiye Sena, Bharatiye Nausena aur Bharatiye Vayu Sena, apne atoot drindh sankalp aur bejod veerta ke saath hamesha taiyaar rehte hai desh ki samprabhuta aur naagarikon

How to Find the Best Loan App Online?

Within the ever-evolving landscape of personal finance, the pursuit of effective financial solutions has shifted to the digital arena, where an online loan app has emerged as a pivotal

Say Goodbye to Long Waiting Times: Discover Online Cash Loans

In the current fast-paced world, where time is everything, waiting in long queues for a loan can be a thing of the past. We at Stashfin understand the urgency of your financial

How to Improve Your CIBIL Score Fast?

As per the Reserve Bank of India, it is mandatory that all financial institutions check the credit scores of potential individuals for every type of loan or even credit card at the time of evaluation.

What can a personal loan be utilised for?

In the current fast-paced digital world, financial freedom plays a pivotal role in shaping our aspirations and fulfilling our dreams. As we navigate and turn through life’s twists and turns

Prepayment Penalties on Personal Loans: All You Need to Know

Often known for their flexibility and accessibility, a personal loan easily lends a helping hand in covering various kinds of expenses, consolidating debts, or funding unexpected

Transform Your Finances Today with our Quick Online Cash Loan Services

In the current dynamic world, financial flexibility and accessibility have become of utmost importance. We at Stashfin understand each and every challenge that potential borrowers

Knowing Personal Loan Closure and Part Payment

One of the most availed financial tools that many individuals utilize in the current times is a personal loan. Whether you need the amount for your home refurbishment

Rules, Terms, and Conditions for Instant Personal Loans That You Should Understand

Personal loan! This term is quite trending in the current times where potential borrowers are sitting in their comfort zone and waiting for the loan amount to be credited

Demystifying Personal Loans: Understanding the Ins and Outs

Financial emergencies are often unexpected! Due to this, personal loan, one of the most availed financial tools in the current times, have undoubtedly become a crucial

7 Benefits of Using a Personal Loan to Finance Your Next Adventure

Are you planning to trek through the lush forests in Himachal Pradesh, exploring serene beaches in Goa or a thrilling North to South Road Trip? The allure of such adventure often has a roadblock,

Why You Need a Credit Builder Loan, Now More Than Ever

In the current economic landscape, navigating credit builder is undoubtedly tough and daunting. With financial stability being the top most priority for everyone,

The Different Components of a Debit Card: An Anatomy

When it comes to banking in 2024, debit cards have become an indispensable part of modern banking, offering potential individuals a convenient and secure way

CVV Number: What Is It? How does it operate? Where can I locate it?

As technology advances, the trend of online shopping is witnessing major growth with each day passing by. From lifestyle goods to electronic items to even groceries,

Purchasing Now, Pay Later against Personal Loans and Credit Cards

In recent years, the concept of “Purchasing Now, Pay Later” has gained immense popularity among the people of our country. As they seek complete flexibility in managing

Which is preferable, personal loans or overdrafts?

When faced with unexpected financial obstacles or planning for some significant expenses, individuals often find themselves in a haystack, debating whether to opt for a personal

How Do I Apply for a Personal Loan Without Proof of Income?

Availability of a personal loan is usually a straightforward process for individuals with a stable income, as it provides lenders with a sense of financial stability and safety.

A Comprehensive Approach to Financial Planning and Credit Score

When it comes to financial planning, are you hearing about the ‘credit score’ for the first time? What is this three-digit number, and why is it so important

Use a personal loan to pay for your immediate needs

You never know when you might need immediate access to funds for certain unforeseen expenses. In such circumstances, one can either look towards

How to Improve Your Credit Score in 5 Easy Steps

It is a well-known fact that in the current financial landscape, your credit score holds significant importance over your ability to avail of certain facilities. These can be securing loans, o

Credit Card vs. Personal Loan vs. Purchase Now Pay Later

Apart from your salary, do you always look for additional funds to fulfil various kinds of expenses or aspirations? Well, then, you have just landed on the right page.

Personal Loan Benefits You Must Know

In the current sphere of financial management, an instant personal loan stands out as a versatile avenue that offers tons of benefits. Whether you’re looking for debt consolidation,

How to get Personal Loan Online Instant Approval with zero paperwork?

In the current fast-paced digital world, we are all surrounded by unexpected and uncontrolled expenses. Our financial plans go for a ride when it comes to such expenses,

4 ideas to get a personal loan with the lowest processing and interest costs

One of the most trending avenues for financial assistance nowadays is a personal loan. Long gone are the days when people actually had to rely on their friends or relatives for extra income.

Get the fund you require with a personal loan from Stashfin

Are you looking for some financial assistance in order to fulfill your personal objectives? Well, stop asking your friends or relatives for some help and straight away apply for personal loan.

Calculate your EMI using personal loan EMI Calculator

Are you planning to buy the latest smartphone you have been eyeing for a long time? Or do you want to surprise your loved ones with their dream vacation? Well, the days

Know here the process to check your Stashfin personal loan eligibility

Gone are the days of lengthy paperwork and repeated visits to bank branches for personal loans. Today’s digital age offers a much faster and more convenient option—an instant personal loan.

Things you should know before taking out a personal loan for small business

In the sphere of entrepreneurship, easy access to capital is often crucial for initiating or expanding a small business/venture. While there are various financing options available

Guarding your Career: The importance of Job Loss Insurance in India

Job loss is a dreaded situation that can leave individuals feeling financially insecure and uncertain about their future. With the Indian job market being volatile and unpredictable,

Exploring Cyber Insurance: Importance and Coverage

The evolution of financial technology or fintech, such as the digitalization of banking and insurance processes, has increased online fraud. Cyber security breaches have become

How to Apply and What a Salary Advance Loan Is – Eligibility

Modern life means a lot of hustle and bustle. Do you agree? Financial emergencies are something that can arise at any point in life, leaving one in a tussle to find instant solutions.

Exploring Personal Loan Insurance: Importance and Coverage

Taking out a personal loan can be a significant financial decision. Whether you need funds for a major purchase, debt consolidation, or emergency expenses, it’s crucial to conside

The 5 Cs of Credit: What They Are and Why It Matters

In the sphere of finance, lending decisions are not made with just a single tap or on a whim. Whether you’re applying for a Credit Line Loan, a home loan, or only

How to Make Goals for Your Personal Loan

When it comes to personal finances, setting goals for them has become quite crucial in order to achieve financial stability, build long-term wealth, and realize your aspirations.

How Can Someone Without a CIBIL Score Get a Quick Loan?

In India’s bustling financial landscape, a good credit score, often represented by the CIBIL score, holds quite a crucial importance in accessing loans and other credit facilities.

Does applying for a loan have a negative effect on credit score?

Whenever the time period “Online Cash Loan” strikes, there are lots of misconceptions that revolve around it. One of the most commonplace ones is that making use of any such

Apply personal loan online with the lowest interest rates and instant approval

Are you planning to take out a Low Interest Personal Loan Online? Do you have pressing necessities to fulfill and are not able to set up monetary assistance? Well, you have

Which is better for you—Stashfin Credit line or instant personal loans?

Life sometimes throws an unprecedented turn of events, and you are left with nothing but to resort to external sources to borrow extra cash. The next confusion, therefore

Benefits, Types, and Interest Rates of Small Personal Loans

In the current financial sphere, financial flexibility is everything. Whether it’s covering unexpected expenses, consolidating debt, or investing in potential opportunities,

Home Insurance – Features and Advantages

Home insurance is an insurance policy that covers the costs and damage to your home or any insured property. It is a form of property insurance and one of the several types of general insurance products.

5 indicators to look out for personal loan scams

Do you accept the fact that unexpected financial needs can arise at any point in life in the current fast-paced world. Long gone are the days when individuals actually

Fast Cash Loans: Obtain Online Payday Loans for Urgent Financial Needs

When it comes to your day to day expenses, they can pop up anytime, leaving you scrambling to make ends meet. Emergency medical bills, car repair or refurbishment

How long does it take to build credit?

Establishing a credit history is crucial for accessing financial opportunities, but it takes time and effort. Here’s what you need to know about building credit in India,

How to Repay Your Debts?

Dealing with debt can be overwhelming, whether it’s due to medical bills, overspending, or unexpected expenses. It’s crucial to address the issue step by step,

Navigating the Digital Era: Safeguarding Against Financial Fraud in India

In today’s digital landscape, convenience often comes hand in hand with the risk of financial fraud. With identity thieves and scammers lurking in the shadows,

5 tips on how to get an excellent credit score

In today’s dynamic financial landscape, having an excellent credit score holds the key to unlocking a world of opportunities and financial stability. But what

A comprehensive guide to managing quick personal loan

When you begin earning difficult-earned cash in your career, you in the end understand that handling all of it calls for a lot of perseverance. Long gone are the days when coping

Understanding Insurance: Your Shield for Life’s Uncertainties

In today’s rapidly changing world, insurance stands as a crucial pillar of financial security and risk management, particularly for the Indian audience. It acts as a protective

How to use a personal loan to start a business online!

Are you planning to start a business online? Are you still of the thought that starting an online business doesn’t require any funds and is relatively easy? Well, you need to take a back step here.

How to build a emergency corpus

In today’s uncertain times, having an emergency fund is not just a smart financial move—it’s a necessity. Here’s why you should have one and how to make the most of it in the Indian context:

Travel Insurance: Is It Worth It and When Do You Need It?

Travel insurance is a crucial aspect to consider before embarking on a trip. It provides coverage against various risks associated with travel, particularly offering financial protection

Understanding Health Insurance: Things to know for choosing the perfect insurance for you

Ensuring good health is not just essential for happiness, but also for prosperity. While many of us strive to lead healthy lives and adopt better lifestyles for choosing best health insurance,

Preventing Telemarketing Frauds

Phone scams are common occurrences, often enticing individuals with the promise of lucrative prizes or attractive business opportunities. These scams, prevalent

Personal Loan Vs Credit Card. Which is right for you?

While both credit cards and personal loans serve as prevalent borrowing options, they function divergently and offer unique advantages and disadvantages.

Hard inquiries vs soft inquiries : What is the difference?

Both hard and soft inquiries, also known as credit checks, play a significant role in your credit report. However, it’s crucial to understand the differences between

Quick Online Loan Approval: Get the Financial Support You Need Immediately

Are you looking for financial support in your life? Do you hesitate to ask your relatives or friends for it? Well, then, you need not worry! Stashfin, one of the leading platforms for Quick Online

Getting the lowest interest rate for personal loan: A step-by-step guide

Are you making plans to avail the lowest interest rate for personal loan? Well, you have fortuitously landed on the proper page. We at Stashfin agree that feasibility and convenience have

How to Get Fast Loan With Stashfin App for Instant Approval

Are you looking for a personal loan? Do you want to fulfil your personal objectives and goals without asking for favours from anyone? Well, you have just begun to read the right

Tips for Credit Card Fraud Prevention

Even if you have little to no liability on your credit card, falling victim to fraud or identity theft can cause major headaches for both customers and banks. While the bank’s zero-liability

Insurance 101: Decoding Complex Insurance Jargon

Understanding insurance policies can feel overwhelming, with all their complicated terms and details. But knowing the basics is really important so you can make smart choices

Calculate your Personal Loan EMIs here: Things to think about before applying for a Instant Personal Loan

Are you looking for instant financial needs? Stashfin is here for you! With only a few taps for your smartphone, you may effortlessly avail a no cost emi personal loan from

Apply for mobile loan with Flexible Repayment Option with Stashfin.

Are you looking for a mobile loan? Do you want some financial assistance in order to fulfil your personal objectives and needs? Well, you have just started reading the right article.

How to Rebuild your Credit

Many individuals encounter hurdles with their less-than-ideal credit scores, but there’s a silver lining. With careful planning and prudent financial habits, you can take steps

What is bad debt, and how do you deal with it?

Bad debt is when a customer can’t or won’t pay you what they owe, leaving you with a loss. This affects your business’s financial health and cash flow.

What Is Loan Restructuring & How Can It Benefit You?

Unlocking the complexities of loan restructuring in India offers a lifeline for those grappling with repayment challenges. This insightful guide navigates through

What is Credit Builder and How can it Help to Improve the Credit Score?

A wholesome credit rating is no longer considered a privilege in our country; it’s quite a necessity. From securing loans for homes and cars, an awesome score absolutely opens doors

Understanding Umbrella Insurance for Added Protection

Umbrella Insurance extends liability coverage beyond primary policies like Home or Motor Insurance.

How does Late or Missing a Payment Affect CIBIL Score?

TransUnion CIBIL, known as Credit Information Bureau of India Limited, holds significant importance in the loan and credit card application process. A higher CIBIL score enhances the likelihood

Types of Insurance in India

Insurance serves as a legal agreement between the insured individual and the insurance company, offering financial protection against potential losses. With the wide array of insurance

Access Financial Flexibility: Apply Now for Stashfin Sentinel Credit Line!

Are you looking for some financial assistance and don’t want to ask your near ones for the same? Well, this is where we step into the game. At Stashfin, availing of an instant credit

Personal Loan Interest Rate Trends: What to Expect in 2024

If you are looking for an easy and popular option to access funds, then a Low Interest Personal Loan Online is one of the best options. At Stashfin, we offer such a facility with just a tap

Benefits of Gift Cards & Vouchers

In today’s fast-paced world, the convenience of online shopping has revolutionized how we buy gifts. Yet, amidst the plethora of choices, finding the perfect gift remains a daunting task.

Unlock Incredible Savings: Dive into the Amazon Summer Sale 2024

It’s time to rejoice because the much-awaited Amazon Summer Sale 2024 is finally here, and it’s bringing with it a tidal wave of discounts and special offers across a multitude of categories!

Unlock the Perfect Gift: Why Stashfin Gift Vouchers Outshine the Rest

Ever felt the pressure of finding that perfect gift? Well, say goodbye to gift-giving stress, because gift cards are here to save the day! They’re like secret codes that let your loved ones unlock

Maharani Season 3: A Riveting Saga of Power, Vengeance, and Political Intrigue

The highly anticipated return of Sony LIV’s “Maharani” for its third season has left audiences on the edge of their seats. Led by the formidable Huma Qureshi as Rani Bharti,

How to Calculate EMIs for Personal Loan?

When considering taking out an Instant Credit Loan, ensuring that the Equated Monthly Installment (EMI) is affordable is paramount. The EMI, representing the monthly payment

What can affect your CIBIL/Credit Score?

In the realm of personal finance, few things hold as much weight as your CIBIL credit score. This numerical representation of your creditworthiness, ranging from 300 to 900,

Securing a Personal Loan Using Your Mobile: A Step-by-Step Guide

It is a well-known fact that with time, the screen size is decreasing and the screen time is increasing. From computers to laptops to smartphones, we have surely come a long long way.

5 things to think about before applying for an online fast loan

Are you planning to avail of an online personal loan? Well, before actually going for one, there are tons of factors you need to take a back step and consider.

A Complete Guide to Buying the Best Travel Insurance in 2024

Summers calling! As we approach Summer 2024, travel plans are inevitable with our loved ones to our favorite destinations. Be it the lazy beach trip or a view from Himachal

Strategies for Obtaining a Personal Loan on a Low Income: Kaise Apply Karein

Are you planning to gain some financial assistance? Do you face a low income issue? Welcome to Stashfin, one of the leading platforms for Personal Loan Finance.

Home Appliance Insurance- Must-Knows Before You Buy

When you build your home, a space of your own, you realize that everything matters. A lot of hard work, dedication, and persistence goes into filling every corner of your home,

The Importance of Credit Scores in Instant Personal Loan Applications

Are you planning to avail an instant personal loan? Well, in relation to availing such monetary avenues, your credit score surely plays a completely crucial role and this three-digit

Preparing Financially for the Unexpected: Understanding the Significance of Emergency Loans

Well, life is full of unexpected events, and sometimes, these events come with a price! A simple vehicle breakdown, appliance failure, or an unexpected medical emergency can create

Fulfilling Your Travel Dreams in the New Year: Financing Your Adventures with a Personal Loan

Are you planning to go on a dream vacation with your loved ones? Is your financial condition stopping you or halting your plans? Well, there’s no need to worry now! Long gone are the

Understanding Critical Illness Insurance: Coverage and Benefits

Health is wealth! However, within the current generation, due to the pampered way of life, clinical emergencies can strike any person at any time. Critical ailments like most cancers,

Loan Insurance: All type of Loan Protection Insurance Plan

In India, do you agree with the fact that taking out a loan can be a significant financial decision as it helps in achieving desirable goals for individuals? However,

Escaping a Debt Trap Using a Personal Loan: Strategies and Tips

Drowning in debt? It can feel quite overwhelming like being stuck in a never-ending cycle of minimum payments and unnecessary mounting interest. In our country

Securing Personal Loans for Self-Employed Individuals in India: A Comprehensive Guide

If you’re a self employed individual in India, you recognize it may be both rewarding in addition to tough. However, there would possibly come a time while you’ll require

Mahindra XUV 3XO: A Game-Changer in the Compact SUV Market

Mahindra has officially launched the XUV 3XO, a facelifted version of the XUV300, starting at Rs. 7.49 lakh (ex-showroom). This revamped model aims to redefine its segment,

Protecting Yourself from UPI Frauds: Essential Tips for Safe Digital Transactions

Unified Payment Interface (UPI) has revolutionized cashless transactions, offering a seamless way to make online payments. However, with its increasing popularity,

Maximizing Financial Management: Exploring the Stashfin Sentinel App

Are you planning to avail a no cost emi personal loan? Do you have some personal obligations or objectives that need to be fulfilled on a priority basis? Well, Stashfin is here for you!

Risks associated with instant personal loan apps and security advice

It is a well-known fact that the demand for the best instant personal loan apps has witnessed a significant upsurge in our country, assuring quick and easy access to credit.

Intelligent Borrowing Tactics: Utilizing a Personal Loan EMI Calculator

Are you planning to avail a no cost EMI personal loan? Well, don’t just straight away jump onto applying for it! It is quite necessary to make sure that you have everything planned

Closing the Divide: How Instant Personal Loan For Salaried Assist with Unexpected Expenses

You might be well aware that unexpected expenses can occur at any point in life. Whether your vehicle has broken down, a medical bill is pending, or your home or workspace requires

Fast Approval: Practical Tips for Salaried Employees Applying for Personal Loans

Are you a salaried employee? Then, you must be well aware that sometimes sudden expenses arise unexpectedly, which ultimately leaves one in a financial tussle.

Short-Term Personal Loans in India: Features, Advantages, and Interest Rates

Planning to avail a personal loan? Well, life can be unexpected at several stages and tends to throw arrows at you. Sometimes, these sharp arrows come in the form of urgent

All set for the upcoming journey? See why having travel insurance is essential.

All set for the summer trip? Your bags are packed, tickets are booked, accommodations are confirmed, and your dream vacation is just around the corner.

Common Myths related to Loans

Are you planning to avail an instant loan? Well, as a well-conscious citizen, you would possibly have long gone on the internet and loaded yourself with heaps of statistics.

Reality of Digital Personal Loans: Reduced Paperwork, Not Completely Paperless

In today’s fast-paced and digital sphere, convenience is the utmost important factor to consider and this undoubtedly extends to our financial needs as well. In recent times

Understanding Your Choices: Choosing Between Overdrafts and Instant Loans

Life is unexpected and often throws financial curveballs at you! Whether it’s an unexpected vehicle repair or a medical emergency, the requirement of cash is quite stressful in such situations.

Do Small Online Loans Aid in Taxes? Sorting Reality from Myth

There is no doubt in the fact that small loans online have become a popular solution for bridging temporary financial gaps. With their easy application process and instant disbursal,

What are the details of Child Education Insurance Plans?

In our country, education is undoubtedly a stepping stone to social mobility and a brighter future. Here, for parents, planning the best education for their infant is paramount

Dos and Don’ts of Credit Monitoring

In the current financial landscape, credit tracking has come to be a vital issue of maintaining financial fitness. In our country, in which financial attention is developing in a rapid manner

Definitive Guide to Negotiating Lower Interest Rates on Personal Loans

Personal loans, also known as an instant loan online, one of the most trending financial assistance in 2024, act as a lifesaver for various needs. From consolidation of debt

Securing Your Debt With Best Loan Protection Insurance

While we plan something in our life, surprising activities might disrupt its stability. In such conditions, debt can become a burden, mainly if the loans are of huge amounts.

A Simple Guide to Corporate Bonds

When it comes to investing, having a mix of different types of assets is crucial. Stocks can offer high returns, but they come with significant ups and downs. Corporate bonds,

Best Investment Options in India for 2024

Investing wisely is crucial for financial stability and security. Whether you’re a cautious investor or willing to take on more risk, India offers a variety of investment options.

Loan Protection Insurance Plan Including Critical Illness Rider

In the current times, managing financial risk is of utmost importance as we all have witnessed the Covid-19 phase in our lives. This pandemic has guided each and every individual

Child Insurance Plans: Buy Child Education Plan Online in 2024

In modern times, one of the pinnacle priorities for everyone is to offer quality schooling to their kids for a vivid future. However, one critical thing of securing a toddler’s destiny is making

Using a Personal Loan EMI Calculator to Plan Your Budget

Are you planning to avail a personal loan with EMI? Well, before availing one, keep in mind that planning a budget is quite a crucial step to ensure that none of your finances are affected.

Travel Safely: Planning a Monsoon Vacation with Personal Loans

Raindrops and the lush green landscapes, and the crisp air – the upcoming monsoon in India holds its own charm. It’s basically the best time to rejuvenate and explore. However,

Safety First: Securing Your Home with Fast Cash Loan for Security Upgrades

In the current and rising era of uncertainty, residence security has become a significant concern for families across our country. However, it’s far well-known that safety upgrades can be expensive,

Homeowners Insurance: How Much Does It Cost?

Owning a home, mainly in India, is pretty a massive achievement which comes with an important set of duties. One of the most critical ones is protecting your funding with homeowners insurance.

What is a demat account?

In the modern-day digital age, the most crucial elements of our lives have grown to be virtual, permitting us to manage the entirety with just a few taps on our smartphones

Building Your Emergency Fund: Steps to Take with a Small Loan App for Financial Security

In the current rapidly changing and fast times, financial stability is paramount, and one of the cornerstones of financial security is having a solid emergency and safety fund

Opt for mobile loans with mobile personal loan app

Are you planning to take out a mobile loan? Well, in 2024, this is one of the best things technology has to offer, as you can access financial facilities with just a single tap. Long gone are the

Corporate Bonds: A Comprehensive Guide for Self-Employed Investors

If you’re a self employed person in India, you are probably well privy to and well-versed in coping with your earnings and costs. However, building a stable monetary destiny calls for a completely

Difference Between Listed and Unlisted Bonds

Investing a part of your income is one of the most crucial decisions one should make. While some people are risk takers, others are risk averse. The people in the former category prefer investing

What to Look For When Investing in Bonds?

Investing a significant amount of their income is a practice that everyone should follow. While investing is a healthy practice, the choice of where exactly to invest is a difficult one. The ideal

Maximizing Your Wallet Protection Plan: Tips and Tricks for Optimal Security